Economic development being a prime focus by the government of India, it has been successful in launching many schemes which have passed on the benefits to that segment which had always been on the other side of the road. With these schemes not only economic development has taken place at a higher pace in this segment but also, there is a surge in overall growth and improvement in the standard of living. We have collated a few of the schemes that can give you a quick insight on the benefits and the beneficiaries. Let’s start with

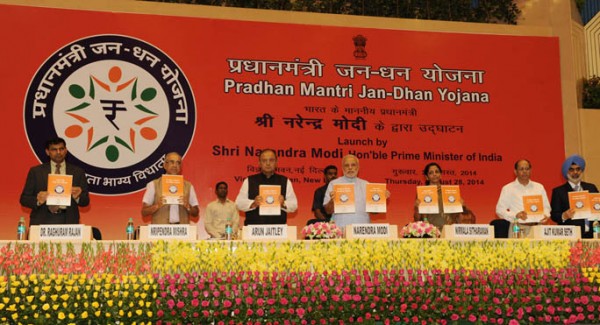

- Pradhan Mantri Jan Dhan Yojna (PMJDY)

This scheme is launched for the economically weaker sections of the society, especially the ones who do not even have a bank account. Pradhan Mantri Jan Dhan Yojana facilitates basic financial services like Savings Account, Deposit Account, Insurance, Pension, Remittances, etc. It’s a national mission for Financial Inclusion and was announced on the eve of Independence Day, in 2014.

This scheme is launched for the economically weaker sections of the society, especially the ones who do not even have a bank account. Pradhan Mantri Jan Dhan Yojana facilitates basic financial services like Savings Account, Deposit Account, Insurance, Pension, Remittances, etc. It’s a national mission for Financial Inclusion and was announced on the eve of Independence Day, in 2014.

Beneficiaries

Individuals who do not have any access to basic financial services and for individuals working in an unorganized sector.

Features

- No minimum or maximum contributions

- 1 lakh accident insurance cover, Rs 30000 life insurance cover for people who have opened a bank under this scheme

- 4% interest/year on money deposit

- No minimum balance

- Get money of government schemes directly in your bank account

- Overdraft facility up to Rs. 5,000 is available after operating bank account for 6 months

- Sukanya Samriddhi Yojna (SSY)

This project was launched under the ‘Beti Bacho, Beti Padhao’ campaign on 22nd January 2015. The aim of this scheme is to meet the education and marriage expenses of a girl child.

22nd January 2015. The aim of this scheme is to meet the education and marriage expenses of a girl child.

Beneficiaries

A girl child who is less than 14 years of age

Features

- Allows opening of one account per girl child with a maximum of 2 such accounts per family

- Minimum Rs. 1,000 and a maximum of Rs. 1.5 lakh can be deposited during a year. You can deposit money in the account till completion of 14 years, from the date of opening of the account

- The account can be closed only when the girl turns 21

- If the money is not withdrawn even after the girl turns 21, interest is still earned on the amount in the bank account

- Pradhan Mantri Jeevan Jyoti Bima Yojna (PMJJBY)

This is a life insurance scheme backed by the Government of India. The same was introduced in the 2015 budget. It was launched with an aim to increase the number of insurers in India as the number was very low.

same was introduced in the 2015 budget. It was launched with an aim to increase the number of insurers in India as the number was very low.

Beneficiaries

- Individual who is the sole earning member of the family having dependents under him or her

- Anyone who has a bank account and is in the age group between 18 and 50 years can avail the scheme

Benefits

- Life cover of Rs. 2 lakhs is available at a payment of Rs. 330 per annum

- Death benefit received by the nominee

- The cover is for one year and can be renewed every year

- Rashtriya Swasthya Bima Yojana (RSBY)

A scheme which was introduced in 2008 with a core objective of providing health insurance coverage to people belonging to the BPL (Below Poverty Line) category.

Benefits

- It provides health insurance coverage to unorganised sectors, like construction, sectors registered under Welfare Boards, Street Vendors, Licensed Porters (railway, MNREGA workers, mine workers, auto or taxi drivers, etc.)

- Coverage up to Rs. 30,000 on a floater basis for family consisting of 5 members

- Coverage for transportation charges of Rs. 100 per visit to the hospital with a maximum limit of Rs. 1,000

- Premium of Rs. 30 per annum and BPL families get an RSBY smart card that allows the holders to claim medical care expenses up to Rs. 30,000 per annum

- Pradhan Mantri Mudra Yojana

Micro Units Development & Refinance Agency Ltd. (MUDRA) is an initiative targeted to the non-corporate, non-form sector, micro and small enterprises whose credit needs are below Rs. 10 lakh. The program was announced by the Finance Minister during the  Union Budget 2016. PMMY offers three products bases the segments that fall under the eligibility criteria:

Union Budget 2016. PMMY offers three products bases the segments that fall under the eligibility criteria:

a. Shishu: Offers loans of up to Rs 50,000

b. Kishore: Offers loans of up to Rs 5,00,000

c. Tarun: Offers loans of up to Rs 10,00,000

Benefits

-

-

- Mudra loans for vehicles (Commercial vehicle, car, and two-wheeler)

- Business Instalment Loan (BIL): a loan for working capital requirement, buying plant and machinery, renovating offices, etc.

- Business Loans Group Loans (BLG) and Rural Business Credit (RBC): an overdraft facility and working capital loans

- Repayment of the loan in as high as 7 years

-

Apart from these, there several are schemes that the government of India has implemented or is implementing at the grassroots level for businesses, agriculture, education and others.